Move Approvals, Billing, and Financial Work Faster

Run automated financial workflows across systems for approvals, billing, and reporting without delays.

Automate top apps for Finance and Accounting

Ready to use automation templates for Finance and Accounting

Automate Instagram Comment Replies with Smart DMs

- text is ai

ReplytoComment

ReplytoComment Send a Private ReplyAdd Step

Send a Private ReplyAdd Step - Is guide comment

ReplytoComment Guide

ReplytoComment Guide Send a Private Reply GuideAdd Step

Send a Private Reply GuideAdd Step - multi keyword matchcmntdqJzLMYS

ReplytoCommentMultiKeywordAdd Step

ReplytoCommentMultiKeywordAdd Step

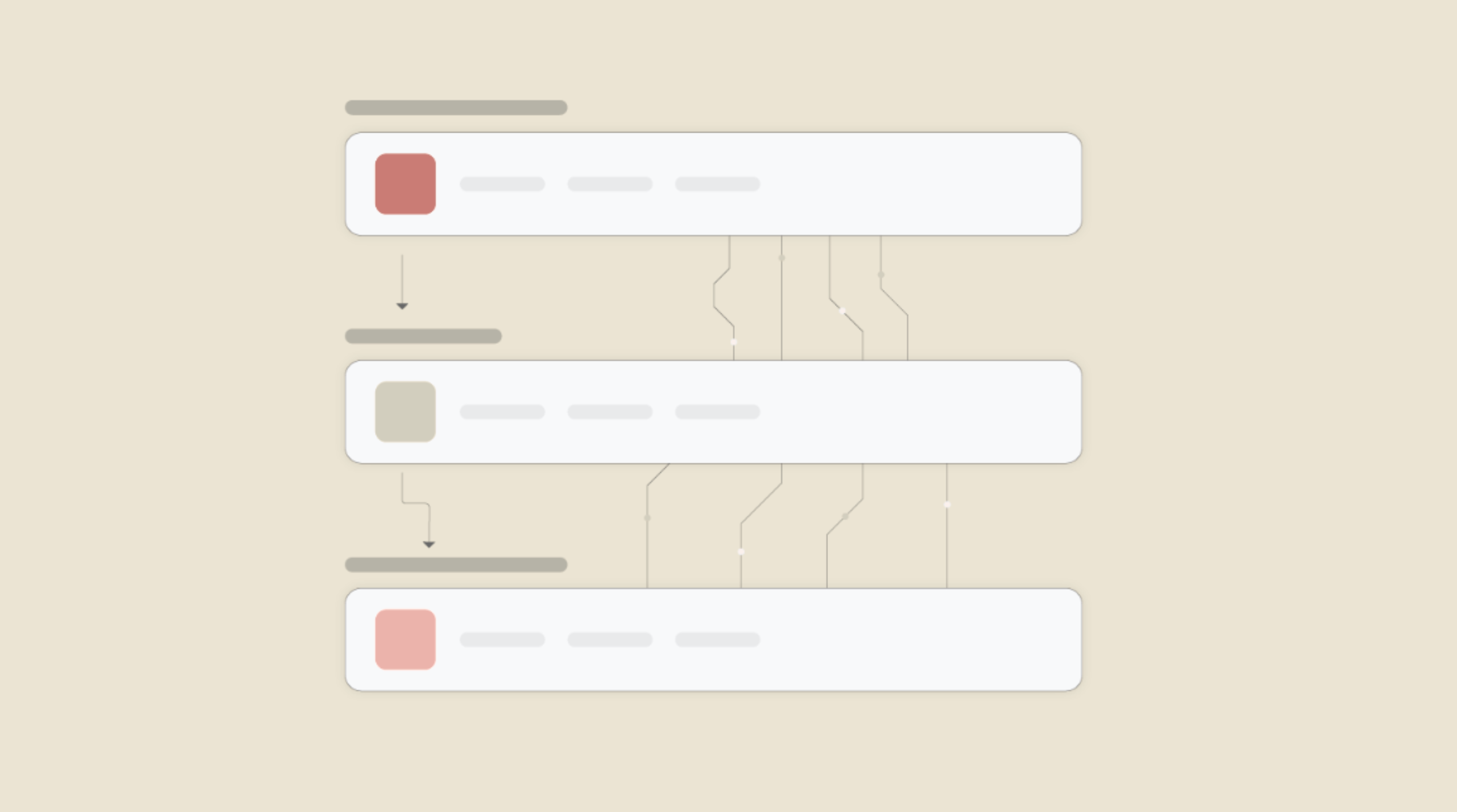

Automate Expense Report Approvals via Slack & QuickBooks

- Send for Approval accept

Create Entry of expensesAdd Step

Create Entry of expensesAdd Step - Send for reject

Mail for RejectionAdd Step

Mail for RejectionAdd Step

Automate Instagram DM Replies, Reactions, and Team Alerts

- has response

SendDMMessageAdd Step

SendDMMessageAdd Step - Notify team

SendMailAdd Step

SendMailAdd Step - has react

SendDMMessage ReactAdd Step

SendDMMessage ReactAdd Step

Invoice Processing & Approval Automation

Manual invoice handling slows down payments and increases the risk of errors, duplicates, and missed approvals.

With finance workflow automation, invoices are automatically captured, validated, routed for approval, and recorded across finance systems. Approvals move faster without manual follow-ups, and payment data stays in sync.

This reduces processing time, avoids duplicate payments, and improves overall cash flow visibility.

Expense Management & Reimbursement Automation

Tracking employee expenses manually is time-consuming and prone to errors, often leading to delays and repeated back-and-forth communication.

With expense management automation, expense claims are validated automatically, routed for approval, synced with accounting systems, and reimbursements are triggered faster.

This simplifies expense handling, improves accuracy, and reduces manual effort for finance teams.

Accounts Payable & Accounts Receivable Automation

Managing payables and receivables manually often results in late payments, missed follow-ups, and inaccurate financial records.

With AP and AR automation, viaSocket syncs invoices, payment statuses, reminders, and collections across finance tools automatically.

This ensures timely payments, better collections, and accurate financial records without manual tracking.

Financial Data Sync & Accounting System Integration

Keeping financial data consistent across accounting tools, ERPs, spreadsheets, and reporting systems is a common finance challenge.

With financial data automation, transactions, journal entries, and updates sync automatically across systems in real time.

This eliminates data mismatches and ensures a single, reliable source of financial truth.

Financial Reporting & Month-End Close Automation

Manual reporting and closing processes often take days or weeks, delaying insights and decision-making.

With automated finance workflows, data is gathered automatically, reports are generated on schedule, and stakeholders are notified without manual coordination.

This significantly reduces the time required for month-end and year-end close activities.

Compliance, Audit & Approval Workflow Automation

Compliance and audits require accurate records, clear approval trails, and strict adherence to deadlines.

With compliance workflow automation, approvals follow predefined rules, audit logs are maintained automatically, and compliance milestones are tracked without manual effort.

This reduces compliance risk and ensures audits are smooth, transparent, and stress-free.

Know More About Finance And Accounting Integrations

How viaSocket Works | A Complete Guide

Gain insights into how viaSocket functions through our detailed guide. Understand its key features and benefits to maximize your experience and efficiency.

5 Simple Automation Hacks to Make Your Team Free

Unlock your team's potential with 5 straightforward automation hacks designed to streamline processes and free up valuable time for more important work.

What is Workflow Automation - Definition, Importance & Benefits | A Complete Guide

Workflow automation is the process of using technology to execute repetitive tasks with minimal human intervention, creating a seamless flow of activities.

Frequently Asked Questions

Automating finance and accounting workflows means using software to handle repetitive tasks like data entry, approvals, invoice processing, and reporting automatically. This reduces manual work and keeps financial processes running smoothly.

Finance teams automate workflows to save time, reduce errors, and improve accuracy. Automation helps teams focus on analysis and decision-making instead of spending hours on manual updates and repetitive tasks.

viaSocket connects accounting tools, spreadsheets, payment systems, and internal apps into automated workflows. When a financial event happens—such as a new invoice or payment update—viaSocket automatically triggers the next steps.

viaSocket can automate invoice approvals, expense tracking, data syncing, payment status updates, financial reporting, and internal notifications. Any rule-based finance process can be automated.

No. viaSocket is a no-code workflow automation platform. Finance and accounting teams can build workflows using a visual builder and templates, without writing code or relying on developers.

Automation reduces manual data entry and ensures every step follows a defined process. This improves accuracy, creates clear audit trails, and helps finance teams maintain better control over their operations.